How To Register An Llc With The Federal Government

Registering the name of a corporation llc or limited partnership.

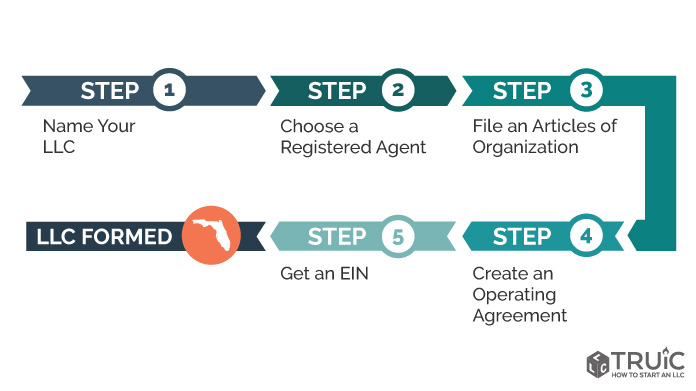

How to register an llc with the federal government. You will leave the irs website and enter the state website. A limited liability company llc is a business structure allowed by state statute. Register with your state for income tax sales tax and employment taxes. If you are from one of these states and you also want to get a federal employer identification number ein you may obtain both your state and federal information in one session. Incorporate your business obtain your articles of incorporation through federal incorporation or provincial territorial incorporation.

Owners of an llc are called members. How to register with nova scotia. Doing business in a state triggers state income tax sales tax excise taxes and state employment taxes if you have employees. Your registration is only considered complete when the province has processed your signed application and accepted your registration fees. If you have successfully formed your llc with the federal government you usually do not have to separately register the.

Each state may use different regulations you should check with your state if you are interested in starting a limited liability company. Get a federal business number and corporation income tax account from the canada revenue agency. Upon llc formation or the creation of your limited liability company you must register your name with the federal government. To register your corporation in nova scotia you need to pay the registration fee of 274 10. To register as a corporation you will need to.

In most states they do not let businesses register as an llc if the name is already registered. Most states do not restrict ownership so members may include individuals corporations other llcs and foreign entities. If you need a business registration number from one of the states listed on this page all you need to do is click on one of the links below. If your company does business in a state it is considered to have a tax presence or tax nexus in that state. How and where you need to register depends on your business structure and business location.